There is no doubt that the music industry stands as one in the belief that artists and other creators deserve to be paid for their work.

But when it comes to the fight to secure performance royalties for AM/FM radio plays, some skeptics question devoting efforts to getting economic justice from a “dying” medium such as terrestrial radio.

But last week Congress brought front-and-center why fighting to get artists paid for radio plays is so critical.

Following aggressive and well-funded efforts by the National Association of Broadcasters (NAB), Congress is moving to protect AM radio by compelling auto makers to keep the 100-year-old technology in cars – even though it interferes with electric engines and would increase car prices.

Have We Discovered Who Spawned the Streaming Mechanical Royalty Rates?

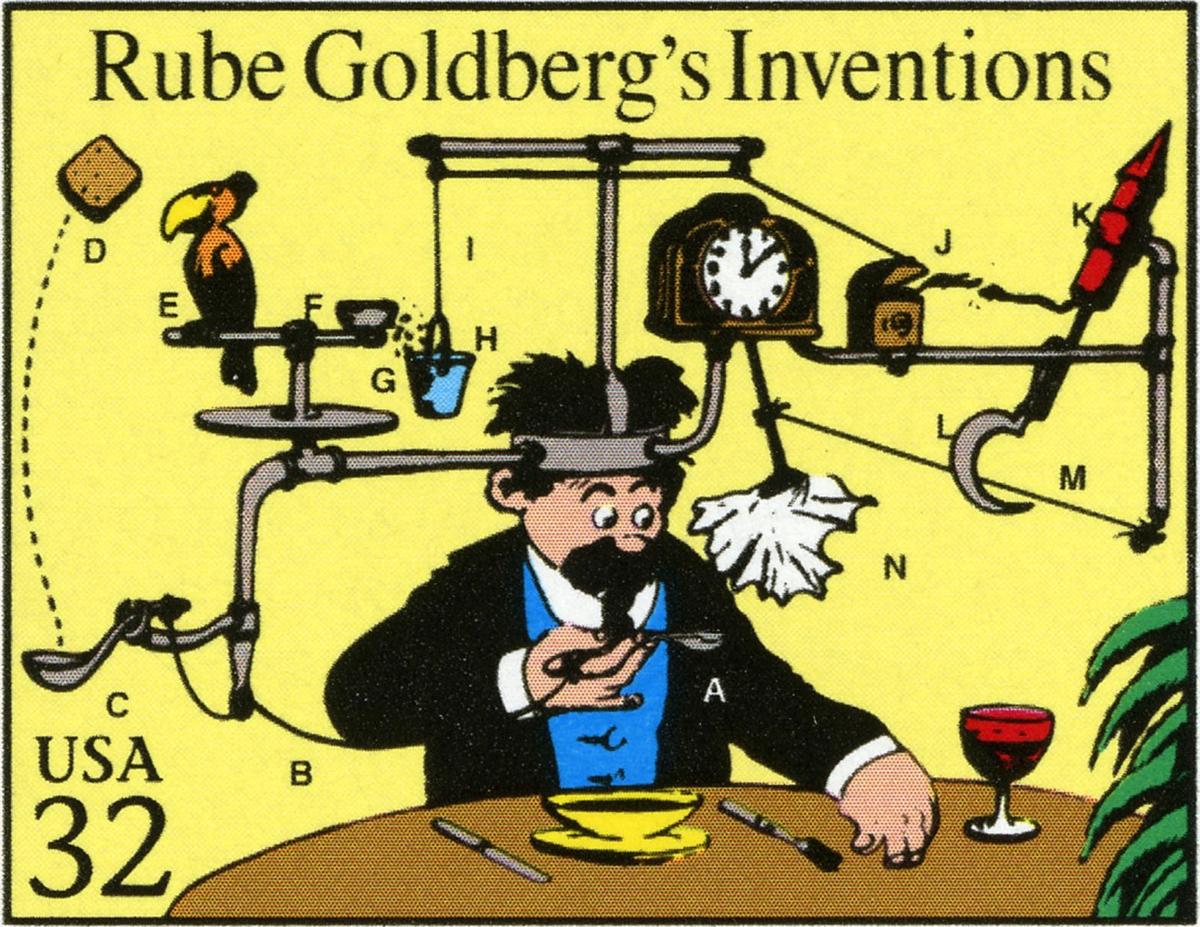

If you’ve actually put on the armor of God and actually read the regulations describing the streaming mechanical royalty, you’ll probably be wondering how Rube Goldberg got into mechanical royalty rates.

Maybe we have discovered who did it. Or maybe he at least came up with Spotify’s bundled rates.

@KevinBrennanMP & UK Committee Releases Important Report on the Impact of AI on Music Industry

Read the report here

@AnsteyEco @JarrellTDillard: Larry Summers Says CPI Raises Chances That Fed’s Next Move Is to Hike

[This is why songwriters should have gotten a cost of living adjustment on mechanicals for streaming.]

Former Treasury Secretary Lawrence Summers said that the hot US consumer price inflation report for March means that the risk case of the next Federal Reserve move to be an increase must be taken seriously.

@UtkarshShetti: US SEC investigating if OpenAI investors were misled, WSJ reports

The U.S. Securities and Exchange Commission is scrutinizing internal communications by OpenAI CEO Sam Altman as part of an investigation into whether the company’s investors were misled, the Wall Street Journal reported on Wednesday.

The regulator has been seeking internal records from current and former officials and directors in the ChatGPT creator and sent a subpoena to the company in December, the report said, citing people familiar with the matter.

The move followed OpenAI board’s decision in November to fire Altman as CEO and oust him from the board. The board of the non-profit startup at the time said it “concluded that he was not consistently candid in his communications with the board, hindering its ability to exercise its responsibilities.”

Altman returned as CEO just days after his ouster, with OpenAI also unveiling a new initial board with former Salesforce co-CEO Bret Taylor as chair.