Songwriters can’t help noticing that streaming mechanicals are the odd man out when it comes to inflation protection from the Congress. Both the MLC’s rich “administrative assessment” payment paid by digital service providers and the physical mechanical paid by record companies each have inflation protection in the form of a cost of living-type adjustment. But it will be another few years before songwriters get another chance to negotiate a cost of living adjustment for streaming mechanicals. This is true, even though the exact same song on the exact same recording gets a cost of living adjustment for physical.

Getting paid a fixed rate in a long term contract requires precautions. This is particularly true if you anticipate volatile activity in the broad economy (sometimes called a “macroeconomic environment”). When your business is forced to accept a price that is fixed by the government, keeping a good eye on macroeconomic conditions is part of your job description. This is a particularly important part of your job when fixed government rates are going to be in place for five years at a minimum and affect the entire world. I say “at a minimum” because as we have seen with the Phonorecords III remand, you can be stuck with crappy rates for much longer if the give and take of negotiations is mismanaged by both sides.

Inflation Free Riding

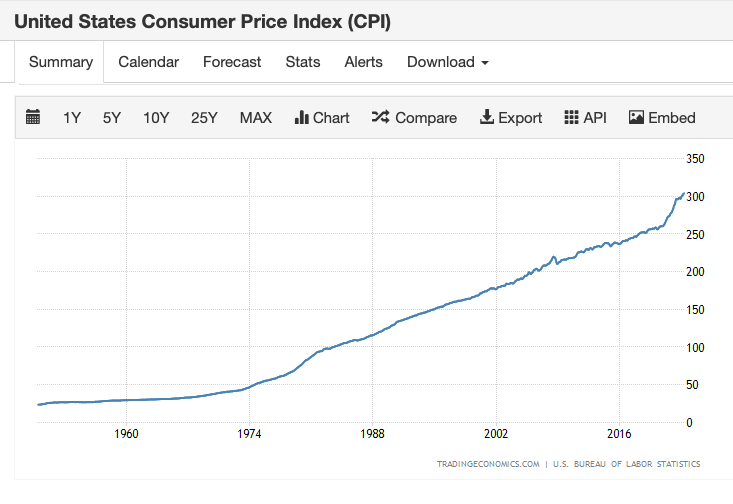

One precaution commonly negotiated is price protection against inflation. Any long-term contract should have inflation protection such as an annual increase based on an objective economic ratio such as the Consumer Price Index (determined in America by the United States Bureau of Labor Statistics). The DSP’s side of inflation protection is the inflation bonus–without inflation protection, DSPs get the bonus of paying future royalties with inflated dollars, also known as free-riding.

There was one bright light in Phonorecords IV. Songwriters will recall how the Copyright Royalty Board rejected the negotiated private settlement by the NMPA, NSAI and the RIAA on physical records and downloads (the Subpart B rates). Due to the outcry from some independent music publishers and songwriters not represented by that bargaining group, the CRB then forced a new negotiation. That negotiation resulted in a settlement that raised the statutory mechanical rate for physical records–plus inflation protection derived from a cost of living adjustment based on the U.S. Consumer Price Index.

This inflation adjustment makes the statutory rate for songs on physical goods and downloads similar to the “administrative assessment” for the MLC, Inc. that the Copyright Office put in charge of operating the mechanical licensing collective. The MLC also has an inflation adjustment in the “assessment” which is the sum paid by services to cover its operating costs.

Unfortunately, the NMPA and NSAI were unable to–or in any event didn’t–negotiate a cost of living adjustment on streaming mechanicals. In other words, the DSPs and the MMA bargaining group (NMPA and NSAI) expect inflation protection when it benefits them, but not when it benefits songwriters. There was also an outcry from some independent publishers and songwriters not represented by the NMPA and NSAI, but it was too late. Instead the bargaining group agreed to extend the trickle down royalty structure largely based on revenues rather than share price. However reluctant this agreement was, it was not based on a workers’ vote like a union collective bargaining agreement. Another missed opportunity. Oh well, maybe next time.

Recession Ahead

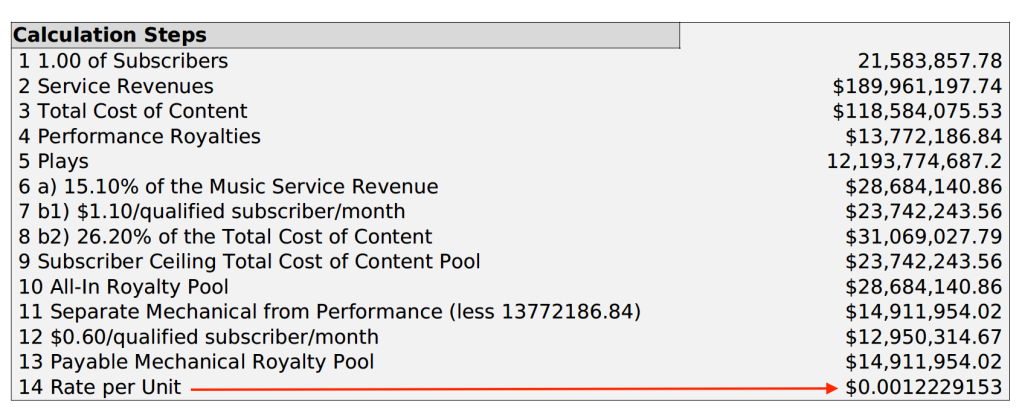

Given the inflationary shockwaves, one might anticipate a recession ahead that highlights the need to preserve purchasing power. One might also want to develop a mindset or theory about how inflation would rot away a fixed rate of return ordered by the government, such as the statutory mechanical rate. Even if one accepted the lack of.a crystal ball, economists make projections all the time, particularly five year projections. (Remember that physical mechanicals is a fixed penny rate so inflation rot is easy to measure. Streaming mechanicals is a bizarre formula that changes the result from month to month and so it is easier to hide the inflationary rot from the streaming mechanical rate–which almost always starts three to four decimal places to the right.)

Sticky Inflation and Economic Bombshells

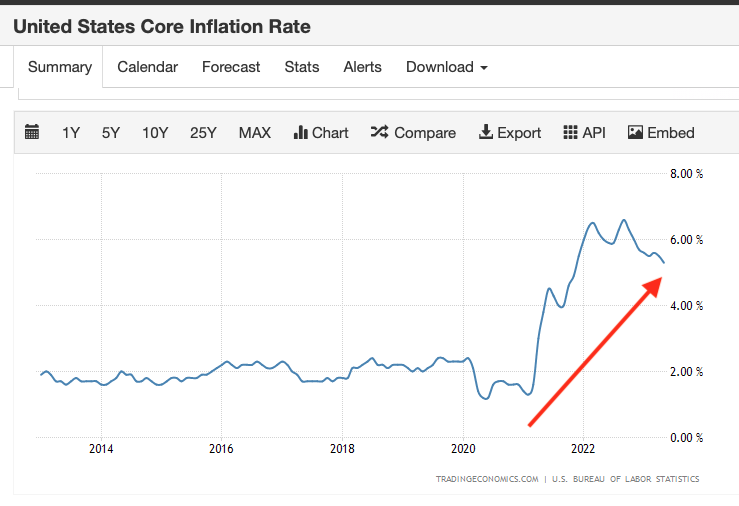

Without reading too much into the global macroeconomic situation, it is pretty simple to see that “core” inflation (like housing, but excluding food and energy) is pretty “sticky” meaning it is not decreasing much despite the best efforts of the central banks, including our own Federal Reserve. US core inflation actually increased in the most recent period. What if inflation increased sharply? How likely is that? What economic bombshells are likely to happen over the next five years? Consider the BRICS nations.

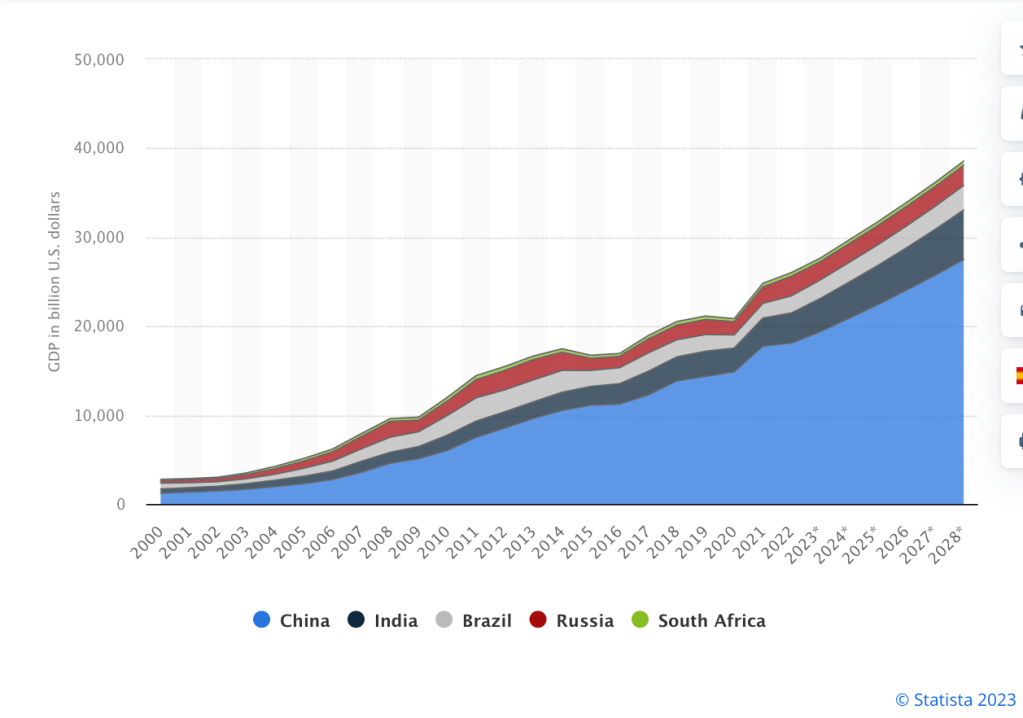

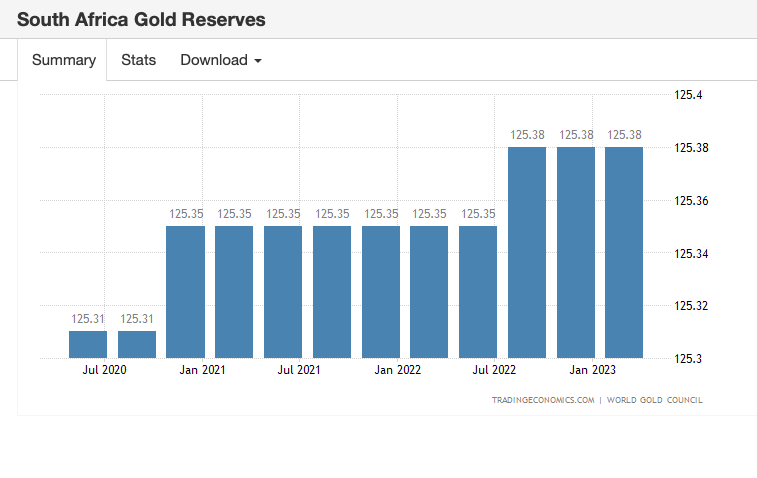

You may have heard of the annual “BRICS” Summit to be held this year on 22 August in Durban, South Africa. BRICS is an acronym of the Brazil, Russia, India, China and South Africa “Partnership for Global Stability”. That’s right, theythink they are about the business of “global stability.” Realize that the BRICS bloc combined had a GDP over US$26.03 trillion in 2022, which is slightly more than the United States.

One of the ways these countries partner for global stability is with currency. A stable currency helps to fight off the inflationary trends associated with the world’s current prime reserve currency, the U.S. dollar. Together these countries account for a substantial amount of world trade and gold reserves. Is it any wonder that BRICS has formed the New Development Bank and the BRICS Contingent Reserve Arrangement as alternatives to Bretton Woods?

Why would a currency backed by gold be attractive? It stops governments from printing vast quantities of currency for one thing. Pegging a currency like the dollar to the price of gold acts as a brake on government spending which is inflationary. Consider that inflation in the US has steadily risen at nearly a 45 degree slope since around 1972. Now what might have happened in 1972 that could help explain that rise?

Will a BRICS currency dethrone King Dollar?

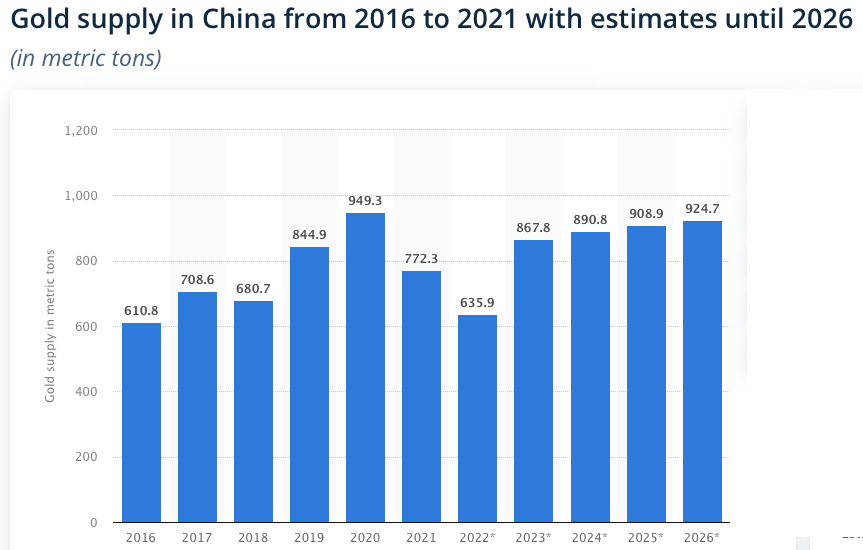

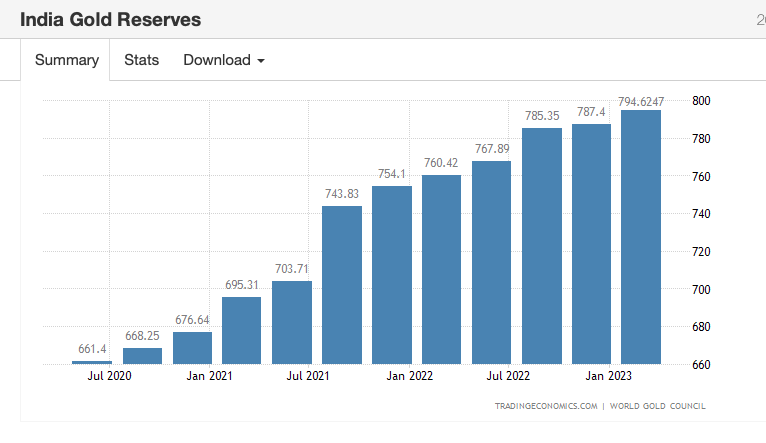

It should not be surprising then that BRICS members have been increasing their gold reserves over the last few years, which is what one would expect to see in advance of forming a currency union pegged to gold. While none of these countries have currency strong enough to challenge the dollar on their own, what if they together were to peg a new currency to gold, what Joseph Sullivan writing in Foreign Policy called a “bric”? What then? No single currency of the BRICS is well suited to replace the dollar, but if a basket of these currencies were pegged to gold, that might be different. If a bric currency were pegged to gold, we might have a ball game that could displace the dollar as a reserve currency at least in the BRICS countries. And that’s a whole lot of commodities the Global North buys from the Global South. We pay for those commodities in dollars–or at least we did.

If that was the plan, would you expect to see the BRICS accumulate gold by purchases in the open market to increase their respective gold reserves?

It should also be noted that the weaponization of the US dollar against Russia seems to have had no effect on BRICS. Their global summit will be held in Durban, South Africa recent events in Russia notwithstanding. In fact, it probably is not an overreach to say that not only do these countries not seem to care about being blocked from the SWIFT banking system alongside fellow BRICS member Russia, the US may find itself blocked from a BRICS banking system and at least given a strong push toward being dislodged as the world’s prime reserve currency.

Getting dislodged as the prime reserve currency wouldn’t happen overnight in all likelihood if history is any guide, but footfalls along the path could definitely be inflationary.

In a nutshell, the effect on songwriters without inflation protection could be as bad as when the government froze rates from 1909-1978, except in a much more compressed time frame.

There are signs and portents. You’ve probably seen press reports about China making significant commercial deals that promote its renminbi (yuan) currency in large scale sovereign resource and development contracts in bilateral agreements with resource-rich BRICS countries. This is particularly seen with China leveraging its position as the largest crude oil importer and recently surged commerce with France, America’s oldest ally. While there’s a long way to go before the renminbi unseats King Dollar as the world’s prime reserve currency, the point is that China is really trying hard to make that happen which is a first. The downside of losing prime reserve currency status would be as devastating as a war and would result in hyperinflation the likes of which America has never seen.

Of course, we won’t go straight to being Argentina, but there could easily be pressures along the way that would cause our inflation to spike, particularly for those who live off of wages fixed by the government from Social Security to the statutory mechanical royalty rate. This makes fighting for Cost of Living Adjustments all the more important.